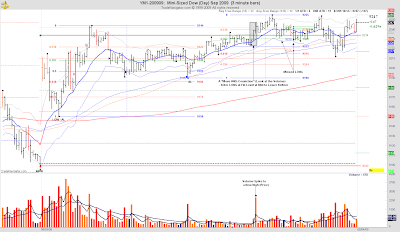

Trade 1: -30, -30 (CT Setup - Double 3Min Bar High w/Lower Low Lower Close)

Trade 1: -30, -30 (CT Setup - Double 3Min Bar High w/Lower Low Lower Close)Trade 2: -12, -12 (Fib Confluence - 38% of Current Day w/ 24% 7/31 MRAL to 8/03 High at R2 Pivot)

Trade 3: +11, +22 (50% Fibs of the Entire Day)

Trade 4: +10, +15 (First Pullback to MAs)

TOTALS: -26 / -$130

LESSONS LEARNED:

- The ONLY time to consider a CT Trade is after 3 to 5 retracements in the trend, OR, NO CT TRADES!

No comments:

Post a Comment