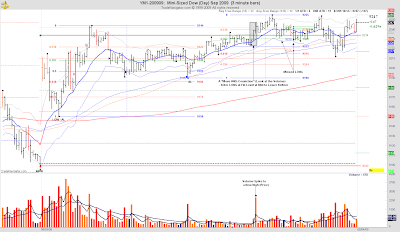

Trade 2: +13, -09 (2nd Retrace: EDRP, Fib Confluence 38% AH to NL2 w/ 50% AH1 to NL2)

TOTALS: +36 / +$180

"The Market will pay you for one thing and one thing only... Your SKILL!"

Trade 1: +29, +39 (2nd Retrace, Up Trend confirmed once HIGH pentrated, Entry at 50% Fibs LOW to NH)

Trade 1: +29, +39 (2nd Retrace, Up Trend confirmed once HIGH pentrated, Entry at 50% Fibs LOW to NH) Trade 1: -09, -09 (Low taken out on High Volume, Entry at Confluence of 50% Fibs w/ Daily Pivot)

Trade 1: -09, -09 (Low taken out on High Volume, Entry at Confluence of 50% Fibs w/ Daily Pivot)

Trade 1: -17, -17 (62% Fibs Entire Day Mid to Upper Keltner)

Trade 2: -13, +17 (1st Retracement (UP Trend), Confluence w/ Prior Day Close and Lower MA between 24% and 38% Fibs Mid to Lower Keltner)

Trade 3: -10, -10 (1st Retracement (Up Trend), Exhibit A, First Pullback to MAs following MKP, Entry on penetration of High of IVB)

Trade 4: +18, +27 (1st Retracement, 50% Fibs of Entire Day testing PL (Minimal Risk w/ ISL just below PL))

Trade 5: +09, +13 (50% Fibs of Entire Day testing PL again in Sideways Range since 1100AM ET (Minimal Risk w/ ISL just below PL))

TOTALS: +17 / +$85

Trade 1: +13, -09 (Aggressive LONG due Time of Day, Pullback Mid to Lower Keltner at 79% Fibs 8/27 MRAL to 8/28 HIGH)

Trade 1: +13, -09 (Aggressive LONG due Time of Day, Pullback Mid to Lower Keltner at 79% Fibs 8/27 MRAL to 8/28 HIGH) Trade 1: +09, +09 (First Pullback to Mid to Upper Keltner, Confluence w/ S1 and Prior Day Low (Resistance confirmed by High of ERVB Volume Spike at 1003ET)

Trade 1: +09, +09 (First Pullback to Mid to Upper Keltner, Confluence w/ S1 and Prior Day Low (Resistance confirmed by High of ERVB Volume Spike at 1003ET) Trade 1: -17, -30 (Pullback to MAs w/ Expectation of Continuation of DownTrend from Prior Day)

Trade 1: -17, -30 (Pullback to MAs w/ Expectation of Continuation of DownTrend from Prior Day) Trade 1: +31, +35 (1st Retracement - 50% Fibs 8/24 LL to 8/25 HIGH)

Trade 1: +31, +35 (1st Retracement - 50% Fibs 8/24 LL to 8/25 HIGH) Trade 1: +13, +23 (1st Pullback to Mid to Lower Keltner of the Day, Entry based on Low of ERVB Volume Spike at 1012ET)

Trade 1: +13, +23 (1st Pullback to Mid to Lower Keltner of the Day, Entry based on Low of ERVB Volume Spike at 1012ET) Trade 1: +16, +04 (1st Pullback to Mid to Lower Keltner - Heavy Volume on prior Swing indicated Support from 9457 to 9463, Entry at 9463 near Mid Keltner)

Trade 1: +16, +04 (1st Pullback to Mid to Lower Keltner - Heavy Volume on prior Swing indicated Support from 9457 to 9463, Entry at 9463 near Mid Keltner)

Trade 1: +18, +31 (50% Fibs 8/19 MRAL to 8/20 HIGH and Confluence with 8/19 Close Mid to Lower Keltner)

Trade 2: +08, +14 (38% Fibs Entire Day)

Trade 3: +11, +21 (First Pullback to MAs)

TOTALS: +103 / +$515

LESSONS LEARNED:

- Continue to associate Supply/Demand (Resistance/Support) with Volume Spikes on ERVBs (the Low and/or High of the ERVB). Trade with the Institutions... the Institutions enter the Market at areas of Heavy Volume/Volume Spikes. The Market typically respects the Highs/Lows of ERVBs on Heavy Volume due to Institutional interest (place your stops 1/2 ATR below/above these prices).

Trade 1: +17, -16 (Pullback to MAs)

Trade 1: +17, -16 (Pullback to MAs) Trade 1: +24, +38 (50% Fibs 8/17 end of day MRL to 8/18 HIGH (8/17 HH taken out) at the MAs)

Trade 1: +24, +38 (50% Fibs 8/17 end of day MRL to 8/18 HIGH (8/17 HH taken out) at the MAs) Trade 1: +12, -07 (Strong Down Trend: 24% Fibs Mid to Upper Keltner)

Trade 1: +12, -07 (Strong Down Trend: 24% Fibs Mid to Upper Keltner) Trade 1: +12, +19 (38% Fibs 8/7 HH to 8/10 LOW Confluence w/ 8/7 Close and 8/10 Daily Pivot)

Trade 1: +12, +19 (38% Fibs 8/7 HH to 8/10 LOW Confluence w/ 8/7 Close and 8/10 Daily Pivot) Trade 1: -15, -15 (Pullback to MAs)

Trade 1: -15, -15 (Pullback to MAs) Trade 1: +12, +16 (Fib Confluence 62% 8/4 AL to 8/4 NH and 50% 8/3 AL to 8/4 NH)

Trade 1: +12, +16 (Fib Confluence 62% 8/4 AL to 8/4 NH and 50% 8/3 AL to 8/4 NH) Trade 1: -30, -30 (CT Setup - Double 3Min Bar High w/Lower Low Lower Close)

Trade 1: -30, -30 (CT Setup - Double 3Min Bar High w/Lower Low Lower Close)

Chicago |

New York |

London |

Frankfurt |

Tokyo |

Sydney |

UTC/GMT |